The Middle East’s share of U.S. arms imports has declined in the past decade, thanks in large part to the U.S. policy of ensuring Israel’s qualitative military edge.

From the five-year periods 2014-18 and 2019-23, the Middle East’s share of U.S. arms exports fell from 50% to 38%, according to a 2024 SIPRI report. Restrictions linked to QME are a major factor in this decline.

This legally mandated policy, in place since 2008, binds the United States to ensuring that Israel has a technological and strategic advantage over its hostile neighbors. This approach has strained relations with other U.S. security partners in the region—for example, Egypt, Saudi Arabia, and the UAE—which cannot buy the latest U.S. arms and gear military. In response, these nations have turned to China and other suppliers.

In 2020, the commander of U.S. Central Command warned that this might happen. “We don’t want [U.S. partners in the Middle East] turning to China. We don’t want them turning to Russia to buy those systems,” Gen. Kenneth McKenzie said.

Now, as nations bump their defense spending amid an increasingly unstable world, the U.S. policy of prioritizing Israel’s QME over broader regional partnerships could allow China to become a formidable contender in the Middle East arms market, and drastically shift the balance of power. Already, China is positioning itself as a flexible and pragmatic alternative to Western suppliers, providing competitive solutions with fewer political and operational strings attached.

Here is a look at several regional countries’ major arms projects:

Egypt

Egypt’s French Rafale fighter jets, though advanced, were delivered without crucial long-range systems such as Meteor air-to-air missiles. Negotiations for 24 Eurofighter Typhoons from Italy, valued at $3 billion, and a potential deal with the U.S. for F-15 Strike Eagles, face similar constraints, likely omitting long-range strike capabilities to maintain Israel’s QME. Frustrated by Western limits on long-range weaponry, Egypt has increasingly sought alternative suppliers, particularly China. Beijing has offered the HD-1A supersonic cruise missile to supplement Cairo’s long-rang capability gap. With a range exceeding 180 miles (290 km) and precision targeting, the HD-1A could boost Egypt’s strike capabilities. If integrated, it would challenge Israel’s QME, shifting regional power dynamics.

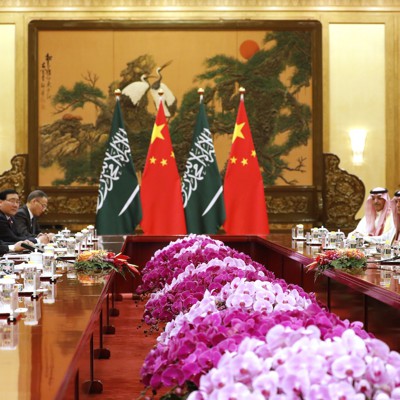

Saudi Arabia

Saudi Arabia, while the largest recipient of U.S. arms in the region, has also faced restrictions on acquiring advanced systems. After being denied access to the MQ-9 Reaper drone, the Kingdom purchased Chinese CH-4 and Wing Loong uncrewed combat aerial vehicles (UCAVs). These drones have been deployed extensively, particularly in the air campaign over Yemen. Saudi Arabia has also acquired Wing Loong II drones comparable to the phased-out MQ-1 Predator.

Riyadh has acquired Chinese Dong Feng (DF) ballistic missiles, including models like the DF-3 and DF-21, after the U.S. refused to sell equivalent systems due to proliferation concerns. The Kingdom has even begun producing solid-fueled ballistic missiles domestically, with Chinese technical assistance, to counter Iran’s missile program.

Reports also suggest Saudi Arabia is talking with China North Industries Group Corporation (Norinco) to procure advanced systems such as the Sky Saker FX80 UAV, CR500 vertical take-off and landing (VTOL) UAV, and loitering munitions like the Cruise Dragon 5 and 10.

UAE

A landmark arms agreement under the 2016 Trump administration included F-35 stealth fighters and MQ-9 Reaper drones for the UAE as part of a $23 billion package. The deal, formalized after the UAE normalized relations with Israel in 2020 under the Abraham Accords, marked a shift in regional defense dynamics. However, in December 2021, the UAE suspended F-35 negotiations with the Biden administration, citing “sovereign operational restrictions” related to the use and integration of the aircraft. Should such negotiations resume under Trump’s second term, the UAE would become the second Middle Eastern operator of the F-35, after Israel.

In the interim, the UAE has sought alternatives. For example, China has offered Wing Loong II UCAVs. Following the hiatus of the F-35 deal from the United States, the UAE pursued alternatives to modernize its air force and improve its military capabilities. The UAE signed a $19 billion deal with France in 2021 for 80 Rafale fighter jets, a clear pivot away from reliance on U.S. systems. These advanced 4.5-generation aircraft are set to replace the UAE’s aging fleet of Mirage 2000s while providing a modern alternative to the U.S.-manufactured F-35 stealth fighter.

Additionally, the UAE has explored opportunities with China. Reports suggest that Beijing’s Hongdu L-15 advanced trainer jet has already been delivered, raising speculation that more sophisticated Chinese platforms, such as the Chengdu J-20 stealth fighter, could be on the UAE’s wishlist.

Read the full article here

Leave a Reply