The massive strike by tens of thousands of Boeing machinists in Washington state will affect the company’s work on the KC-46 Pegasus refueling tanker, the company’s chief financial officer Brian West said Friday.

West’s comments to the Morgan Stanley Laguna Conference came hours after more than 30,000 union members voted overwhelmingly to reject a contract and go on strike.

“The tanker program is going to be impacted by the (Boeing Commercial Airplanes) factory disruption, and now work stoppage,” West said. “That is going to flow through the tanker rates, which is going to be more cost pressure.”

The extent to which KC-46 production might be impacted was not immediately clear, nor was how the strike could impact other Boeing defense programs, such as the U.S. Navy’s P-8 Poseidon. Boeing builds the KC-46 on its 767 line in Everett, Washington, and the 737-derived P-8 in Renton, Washington.

Further statements from Boeing and the Defense Department on the strike’s defense program ramifications were not immediately available.

Boeing management and leaders of the International Association of Machinists districts 751 and W24 reached a tentative agreement on a deal for 33,000 union members that would include a 25% wage increase over the four-year life of the contract.

Union leaders this week told members that while the contract did not deliver everything they sought, it would be “the best contract negotiated in our history” and recommended accepting the deal.

“We have achieved everything we could in bargaining, short of a strike,” District 751 president Jon Holden said in a Monday message to union members.

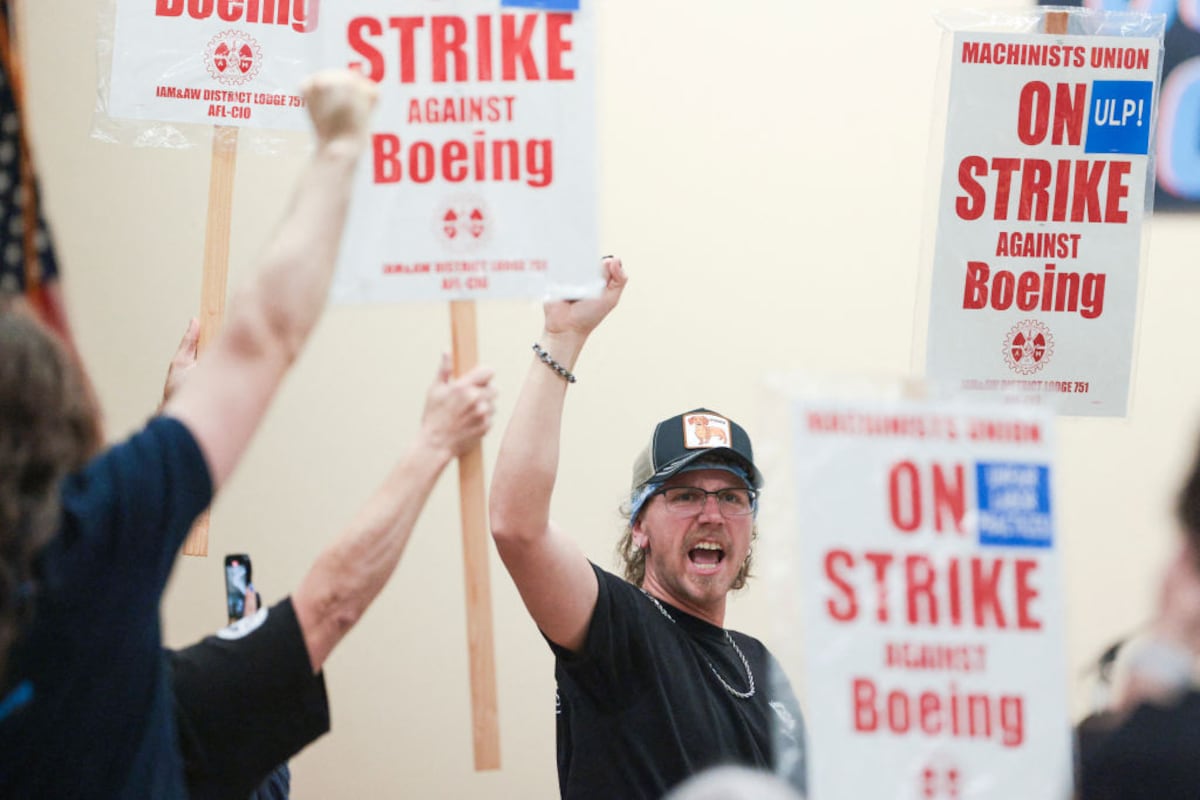

But that deal fell short of the 40% increase the union originally sought, angering rank-and-file members. On Thursday — the final day of the old contract — more than 94% of union members voted to reject the contract and 96% voted to go on strike. Union members are now picketing Boeing facilities in Washington.

West said the company was “disappointed” by union members’ decision to reject a contract and go on strike.

“Initially, we were pretty pleased,” West said. “We had an unprecedented temporary agreement that was unanimously endorsed by union leadership. Over the last few days, it became loud and clear with our union members that that offer didn’t meet the mark. So there was a disconnect.”

Kelly Ortberg, Boeing’s new chief executive, is now speaking directly with workers to hear their concerns and figure out how to find an acceptable agreement, according to West.

A lengthy strike will hurt Boeing’s production, deliveries and operations and jeopardize its ability to recover from its many woes, West said. Those troubles most notably include quality and safety problems with its Max series of airliners.

In July, Boeing pleaded guilty to conspiracy to defraud the United States in connection with the crashes of two 737 Max aircraft. That followed a January incident in which the door plug of another 737 Max blew out in flight.

If the machinists’ strike is not resolved quickly, it could present further dangers for Boeing and its defense sector, which have already weathered one blow after another.

Fitch Ratings, one of the top international credit rating agencies, said Friday that Boeing “has limited headroom for a strike.” If the strike lasts a week or two, Fitch said, the company’s investment-grade credit rating is not likely to change.

But a longer strike, Fitch said, could seriously affect Boeing’s operations and financial outlook and increase the risk of a downgrade.

West said he is confident Boeing can balance its finances and debt and keep its credit rating investment-grade.

However, Boeing Defense, Space and Security is “still in recovery mode” and is likely to lose money in the third quarter, West said. These losses will in part be caused by cost pressures in Boeing’s fighter sector, as it ramps up production of the F-15EX Eagle II fighter and winds down work on the F-18 Hornet, according to West.

“Development hurdles” on the T-7 Red Hawk and MQ-25 Stingray programs, which are fixed-price contracts leaving Boeing on the hook for cost overruns, have also driven up costs, West said.

The U.S. Air Force awarded Boeing a $2.3 billion contract in November 2023 to build 15 more KC-46s, bringing the total number of Pegasus tankers on contract to 153. But the company has also taken significant losses on the program’s fixed-price contract, with the cost overruns topping $7 billion.

Stephen Losey is the air warfare reporter for Defense News. He previously covered leadership and personnel issues at Air Force Times, and the Pentagon, special operations and air warfare at Military.com. He has traveled to the Middle East to cover U.S. Air Force operations.

Read the full article here

Leave a Reply